How 4 engineers ramped to the volume of 50 call center agents in 1 week

You know how most Medicare call centers sound exactly the same? Long hold times, agents reading scripts, customers repeating their date of birth three times?

Spring Venture Group just changed that game entirely. They took their 400+ agent operation and built something their customers actually thank them for.

Here's what happened when their 4-person engineering team got their hands on real voice AI infrastructure.

The Starting Point: 50 People, One Job

Spring Venture Group brokers Medicare Advantage plans. Huge operation with $325M in revenue. They had 50 people whose entire job was asking Are you currently on Medicare? and capturing basic info before transferring to licensed agents.

Sound familiar? It's how everyone does it. And it works... kind of.

Their transfer-to-close rate sat at 12%. Not terrible, but when you're handling thousands of calls, every percentage point represents real seniors getting the coverage they need (and real revenue).

Homer Kay, VP of Data Science from SVG knew there had to be a better way: "We found Vapi's infrastructure and tooling to be the missing layer. More interactive, faster, and more capable than what we could assemble alone."

One Week That Changed Everything

Here's what four engineers built in five days:

Day 1-2: Connected Vapi to their Amazon Connect phone system. Simple transfer to Vapi's infrastructure.

Day 3-4: Built the API to update Salesforce automatically. Perfect data capture every time.

Day 5: Created conversation flows that actually sound human. No more "Press 1 for Medicare, Press 2 for..."

Week 2: Tested with real callers. 50/50 split between humans and AI.

Week 3: Full rollout.

Homer's reaction? "Week one, we knew this was working. The calls sounded right, customers sounded happier, and the system picked up nuances we couldn't capture before."

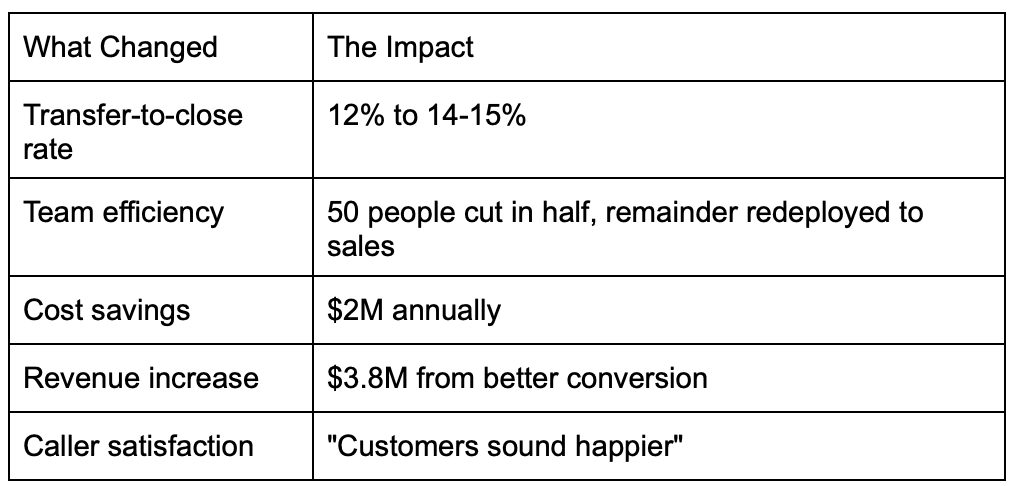

The Numbers That Made Everyone Notice

SVG shared their actual results:

Based on SVG's internal reporting

Based on SVG's internal reporting

That transfer-to-close jump? That's thousands more seniors getting the Medicare coverage they need, faster.

The Secret: Everyone Can Use It

Here's what made this work at scale:

SVG's sales training leaders (not engineers) now create and modify conversation flows themselves. When they notice a common question, they add it. When regulations change, they update the script. No tickets, no delays.

Homer revealed the specific features that made the difference: "The prompt and tooling infrastructure made setup and iteration easy. Model and voice flexibility meant we could switch ASR, LLM, and TTS components. And structured outputs quickly showed the shape of data we'd capture and how it would map downstream."

Translation: Unlike platforms that lock you into their models, SVG has complete flexibility. Need better transcription for Medicare terminology? Switch models. Want different voices? Change them instantly. All without rebuilding anything.

The engineers built the foundation. The business teams run with it daily.

Why This Matters for Medicare

Medicare conversations are complex. Dates, plan codes, eligibility windows. One wrong capture means a senior might miss their enrollment period.

SVG's system now captures this data dramatically better than humans did. Every name, every date of birth, every plan detail. Perfect handoff to agents who can focus on what matters: helping seniors find the right coverage.

The best part? Callers don't even realize they're talking to AI until the transfer. They just know someone listened, understood, and got them to the right person quickly.

What's Next for SVG

With basic qualification transformed, SVG is thinking bigger:

- Complex eligibility conversations with multiple Medicare scenarios

- Predictive routing based on caller needs

- Outbound campaigns for enrollment reminders

- Multi-language support for diverse communities

Each new capability builds on the same platform. No starting over.

The Transformation Formula

Homer summed it up perfectly: "Vapi communicates our brand to people hearing about us for the first time, creates a great customer experience, and ultimately drives happier customers and better close rates."

When your first interaction sounds this good, everything that follows gets easier.

His advice to other insurance companies? "Try it. Create an account and see what happens. You'll likely be surprised by how good it is."

About This Success Story Spring Venture Group transformed their Medicare lead qualification using Vapi's voice AI platform. Implementation: 1 week with 4 engineers. Results: 50 person team cut in half, 15% conversion lift, $5.8M+ in combined savings and new revenue.